Business

India’s Current Account Deficit Shrinks Economic Growth

India’s current account deficit shrinks significantly, marking a positive shift in the economy with stronger exports, lower oil prices, and greater economic stability.

India’s current account deficit (CAD) has reduced significantly, falling to $11.2 billion in the second quarter of the fiscal year. This is a sharp drop from $23.9 billion during the same period last year. The Reserve Bank of India (RBI) shared this data, which has brought hope to economic experts, businesses, and investors. This improvement signals a positive shift in India’s trade balance, showing stronger economic growth.

The current account tracks the movement of goods, services, and investment income. A deficit occurs when a country imports more than it exports. This often raises concerns about relying too much on foreign borrowing and the strain on foreign exchange reserves. In the past, India has faced such deficits, but the recent improvement points to healthier economic conditions.

“Key Reasons for the Narrowing of the CAD”

Several factors have helped reduce India’s CAD.

First, the performance of Indian exports has greatly improved. Key sectors like textiles, chemicals, and pharmaceuticals have grown significantly, bringing in more foreign currency. The IT services sector also continues to play a major role, adding to India’s earnings from services.

Another key factor has been the decline in global crude oil prices. As oil prices have fallen and global demand has slowed, India’s oil import bill has decreased. Since oil is India’s largest import, this reduction has been crucial in improving the trade balance.

“Positive Effects of a Smaller CAD”

The narrowing of the CAD brings several positive outcomes for India’s economy.

One of the most important is that it reduces the country’s need for foreign borrowing, lowering the risks linked to foreign debt. This is especially significant for India, as it still faces a large debt burden.

A smaller CAD also strengthens the Indian rupee. When the CAD is large, the demand for foreign currencies rises, putting pressure on the rupee. But with a smaller CAD, the rupee faces less strain, which may lead to greater currency stability.

Additionally, a smaller CAD boosts investor confidence. It shows that India’s economic fundamentals are getting stronger. A more stable trade balance makes India a more attractive destination for both domestic and foreign investments, leading to long-term growth.

“Ongoing Challenges and Risks”

Although the narrowing CAD is a positive sign, challenges still exist.

The global economy is unpredictable. Changes in commodity prices, geopolitical tensions, and trade disruptions can quickly affect the current account balance.

India’s heavy reliance on imports of oil and gold also remains a concern. Any sharp rise in oil prices or an increase in gold imports could reverse the progress made in reducing the CAD. Addressing these dependencies is essential for maintaining positive growth.

Conclusion: India’s reduction in the current account deficit to $11.2 billion in the second quarter of the fiscal year is a positive sign for its economy. This shift reflects stronger exports, lower oil prices, and a resilient IT sector. While the smaller CAD helps strengthen India’s foreign exchange reserves and increases investor confidence, India must continue focusing on diversifying its economy and reducing dependency on imports to ensure long-term growth.

Watch and Subscribe to the YouTube Channel: EBT Entrepreneur Business Times

Useful Topics:

Entrepreneur Business Times | EBT – Entrepreneur Business Times | Entrepreneurship Latest News & Headlines | Business News | Startup News | CEO Interviews | Automotive News | Pharmaceutical News | FMCG News | Electric Vehicle News | Electrical and Electronics News | Sanitary and Hardware News | Technology News | Politics News | Fashion News | Sports News | Education News | Entertainment News | Video| Entrepreneur Media India | Business News Live | Share Market News | Business Times | Entrepreneurship News India | Entrepreneurship News today | Awards for entrepreneurs in India | Young Entrepreneur Awards India | Latest entrepreneurs in India | Starting a Business | Entrepreneurship in India | Entrepreneur Magazine | Business News Live | Entrepreneur Motivation | Entrepreneur Mindset | Entrepreneur podcast | Entrepreneur | How to become an Entrepreneur | How to be an entrepreneur

Business

Digg Return Challenges Reddit

Digg is making a comeback, backed by Reddit co-founder Alexis Ohanian, with AI-powered moderation to challenge Reddit.

In the ever-evolving landscape of social media and content-sharing platforms, a familiar name is making a comeback, poised to challenge the dominance of Reddit. Digg, the once-popular social news website, is being resurrected with the help of an unlikely ally – Reddit co-founder Alexis Ohanian.

“Digg’s Revival: A New Chapter in Social News Sharing”

Founded in 2004 by Kevin Rose, Digg was a pioneer in user-curated content aggregation. The platform allowed users to share and vote on links, creating a dynamic space for trending news and discussions. At its peak, Digg boasted an impressive 40 million monthly unique visitors, rivaling the engagement levels of today’s Reddit.

However, a controversial redesign in 2010 led to a mass exodus of users, ultimately resulting in the site’s decline and eventual sale in 2012. Now, Rose and Ohanian are joining forces to breathe new life into the platform, aiming to recapture its former glory while introducing innovative features to compete with Reddit.

“Alexis Ohanian: From Reddit to Digg”

In a surprising twist, Alexis Ohanian, the 41-year-old co-founder of Reddit, has thrown his support behind Digg’s relaunch. Ohanian’s involvement adds a layer of intrigue to the project, given his deep roots in Reddit’s success. His decision to back a potential Reddit competitor signals a significant shift in the social news landscape.

Ohanian expressed his enthusiasm for the project, stating he’s “all in on this chapter” of Digg’s revival. This move has sparked curiosity among industry observers and users alike, wondering how Digg’s rebirth might impact Reddit’s market position.

“AI-Powered Moderation: A Step Ahead of Reddit”

One of the key differentiators for the new Digg is its planned implementation of AI-powered content moderation. This innovative approach aims to address one of the most pressing challenges faced by social platforms today – maintaining quality content while managing user interactions at scale.

By leveraging AI for moderation, Digg hopes to create a more efficient and potentially fairer system for content curation. This feature sets it apart from Reddit, which has yet to implement such advanced AI moderation tools.

“Mobile-First Approach and User Interest”

The revamped Digg is being designed with a mobile-first strategy, reflecting the current trends in digital content consumption. This approach could give Digg an edge in attracting younger, mobile-savvy users who may find Reddit’s traditional interface less appealing.

The anticipation for Digg’s return is palpable, with over 175,000 people already signed up for early access. This impressive number suggests a strong interest in alternatives to established platforms like Reddit, indicating potential for Digg to carve out a significant niche in the social news market.

“Conclusion: A New Era of Social News Competition”

As Digg prepares to relaunch, the social news sharing landscape stands on the brink of a potential shake-up. With Reddit’s co-founder backing a rival platform and innovative features like AI moderation on the horizon, Digg’s revival could herald a new era of competition and innovation in social content aggregation.

While Reddit remains a dominant force in the industry, the reemergence of Digg with fresh ideas and high-profile backing presents an intriguing challenge. As users await invites to the new platform, the question remains: Can Digg reclaim its former glory and offer a compelling alternative to Reddit’s established community?

Useful Topics:

Entrepreneur Business Times | EBT – Entrepreneur Business Times | Entrepreneurship Latest News & Headlines | Business News | Startup News | CEO Interviews | Automotive News | Pharmaceutical News | FMCG News | Electric Vehicle News | Electrical and Electronics News | Sanitary and Hardware News | Technology News | Politics News | Fashion News | Sports News | Education News | Entertainment News | Video| Entrepreneur Media India | Business News Live | Share Market News | Business Times | Entrepreneurship News India | Entrepreneurship News today | Awards for entrepreneurs in India | Young Entrepreneur Awards India | Latest entrepreneurs in India | Starting a Business | Entrepreneurship in India | Entrepreneur Magazine | Business News Live | Entrepreneur Motivation | Entrepreneur Mindset | Entrepreneur podcast | Entrepreneur | How to become an Entrepreneur | How to be an entrepreneur

Business

Ultratech Wires Cables India

The new entrant in India’s wires and cables bastion has been nothing short of a buzz in the sector. UltraTech Cement, a major cement company in India, has entered this lucrative sector by announcing plans to invest Rs 1,800 crore in this space in the next 2 years. Birla’s strong saying thrusts wire industry dynamics with a fresh of competitive and innovative era.

“Write a long article that nobody cares about and that has no relevance to the rest of the article“

UltraTech is expanding into the wires and cables segment as the company also aims to become a full building solutions provider. Birla adds this wire manufacturing capability to his already multifaceted portfolio with white cement, wall putty, paints, as well as a new fly ash-based plant in Gujarat.

“Similar Articles on The Ripple Effect on Market Leaders“

The announcement has caused reverberations in the stock market, with established players like Polycab, KEI Industries, and Havells witnessing a decline of as much as 20% in their stock prices immediately after the PLI announcement. Investors are worried that Birla’s big investments and potential for low pricing could create margin pressure and de-rating for the incumbents.

“Nifty Birla Part 1: Synergies and Leverage from Entry

UltraTech’s parent, the Aditya Birla Group, will be able to leverage synergies with its existing business. The group’s copper and aluminum arm, Hindalco, can offer an advantageous raw material cost to the new wires and cables division. Such vertical integration potentially presents UltraTech with an edge in terms of cost and supply chain efficiency.

“Impact on Market Dynamics and Competition“

Birla’s focus on the wire industry and the changing competitive landscape The financial strength and visibility of the brand in construction will be a major threat to all the small players. As firms seek to capture a share of a shrinking pie, some industry analysts predict price wars and ramped-up marketing spending.

“India’s Wires and Cables Sector: Road Ahead“

UltraTech Entering: A Corridor to the Rapid Evolution of the Wires and Cables Industry in India This can lead to better quality products and potentially lower prices for consumers, and existing players will need to adapt and improve their systems to keep their place in the market.

“Investor sentiment and market actions“

The stock market’s initial response reflects the uncertainty about whether the sector can make money in the future. Investors are recalibrating the value of wire-manufacturing companies, especially those at high multiples, as Birla integrates wire manufacturing into its large business model.

Useful Topics:

Entrepreneur Business Times | EBT – Entrepreneur Business Times | Entrepreneurship Latest News & Headlines | Business News | Startup News | CEO Interviews | Automotive News | Pharmaceutical News | FMCG News | Electric Vehicle News | Electrical and Electronics News | Sanitary and Hardware News | Technology News | Politics News | Fashion News | Sports News | Education News | Entertainment News | Video| Entrepreneur Media India | Business News Live | Share Market News | Business Times | Entrepreneurship News India | Entrepreneurship News today | Awards for entrepreneurs in India | Young Entrepreneur Awards India | Latest entrepreneurs in India | Starting a Business | Entrepreneurship in India | Entrepreneur Magazine | Business News Live | Entrepreneur Motivation | Entrepreneur Mindset | Entrepreneur podcast | Entrepreneur | How to become an Entrepreneur | How to be an entrepreneur

Business

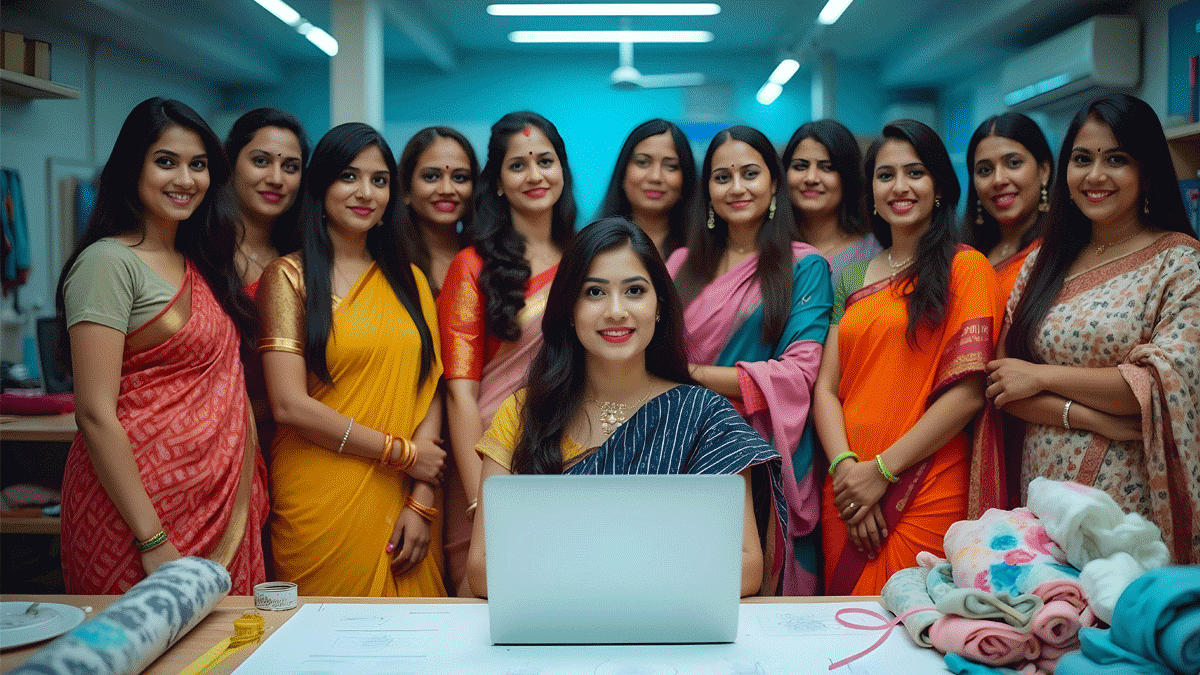

Women Entrepreneurs Modern Economy

Women entrepreneurs are shaping the modern economy by overcoming barriers, creating jobs, and leading innovation across industries like tech, healthcare, and fashion.

“Introduction to Women Entrepreneurs”

Women entrepreneurs are changing the face of the modern economy.

They are breaking old barriers, creating jobs, and driving innovation across various industries. Women-owned enterprises, from small to large corporations, play a big role in economic growth and social development.

“Historical Overview of Women Entrepreneurs”

Early Contributions by Women in Business

Women have been part of businesses for centuries. In earlier times, most women worked from home, making handicrafts or selling products locally. While their efforts often went unnoticed, these early businesses laid the foundation for today’s women entrepreneurs.

Growth Over Time

Over the years, women gained better access to education and legal rights. This helped them move beyond traditional roles to become business leaders. They played key roles during industrialization and have continued to grow ever since.

“Key Reasons for the Rise of Women Entrepreneurs”

- Social and Economic Changes

Movements for gender equality have encouraged more women to start businesses. Changing social norms and laws now support women entrepreneurs. - Better Education

More women now have access to higher education, which has given them the skills and confidence to run businesses successfully. - Technology Advancements

The rise of the internet and digital tools has made it easier for women to start and grow businesses. Platforms like e-commerce and social media help women reach global audiences.

“Traits of Successful Women Entrepreneurs“

- Strong Leadership

Women entrepreneurs often have excellent leadership skills. They know how to manage teams and inspire others to achieve goals.- Creativity and Adaptability

Successful women entrepreneurs think outside the box. They quickly adapt to changes and develop new ideas to stay ahead in business.- Networking and Collaboration

Building relationships is key to business growth. Women often excel at forming partnerships and working with others to expand their ventures.

“Industries Where Women Entrepreneurs Thrive”

- Fashion and Lifestyle

Women have made significant contributions to the fashion and beauty industries. They are leading clothing lines, makeup brands, and lifestyle companies.- Healthcare and Wellness

Women entrepreneurs are focusing on health products, fitness programs, and mental wellness services. Their businesses address important social and health needs.- Technology and E-Commerce

In recent years, women have entered the tech space. They are building apps, software solutions, and e-commerce platforms, changing the face of technology.“Challenges Faced by Women Entrepreneurs”

- Gender Bias and Stereotypes

Women often face doubts about their abilities. Many investors still prefer male-led businesses, making it harder for women to gain funding.- Access to Capital

Women struggle to secure loans or investments for their businesses. They often need to rely on personal savings or family support.- Balancing Work and Family

Many women have to balance business responsibilities with family duties, which can be overwhelming.“How Technology Helps Women Entrepreneurs”

- Digital Marketing

Social media and online advertising allow women to reach a larger audience without huge budgets.- E-Commerce Platforms

Women can now sell their products online to customers worldwide. Websites and apps make it simple to manage sales.- Automation and AI

Modern tools like artificial intelligence help streamline tasks, saving time and effort.“The Social Impact of Women Entrepreneurs”

- Empowering Communities

Women entrepreneurs often become role models, inspiring others to follow their dreams.- Promoting Local Development

By investing in local businesses and projects, women help communities grow.- Giving Back

Many women entrepreneurs donate to charities, support education programs, and fund healthcare initiatives.

“Conclusion”

Women entrepreneurs are a powerful force in today’s economy. They create jobs, promote innovation, and drive social change. Despite facing obstacles, they continue to grow and inspire others. With better funding, education, and support, the future of women entrepreneurs looks bright. They are not just shaping businesses—they are reshaping the world.

Watch and Subscribe to the YouTube Channel: EBT Entrepreneur Business Times

Useful Topics:

Entrepreneur Business Times | EBT – Entrepreneur Business Times | Entrepreneurship Latest News & Headlines | Business News | Startup News | CEO Interviews | Automotive News | Pharmaceutical News | FMCG News | Electric Vehicle News | Electrical and Electronics News | Sanitary and Hardware News | Technology News | Politics News | Fashion News | Sports News | Education News | Entertainment News | Video| Entrepreneur Media India | Business News Live | Share Market News | Business Times | Entrepreneurship News India | Entrepreneurship News today | Awards for entrepreneurs in India | Young Entrepreneur Awards India | Latest entrepreneurs in India | Starting a Business | Entrepreneurship in India | Entrepreneur Magazine | Business News Live | Entrepreneur Motivation | Entrepreneur Mindset | Entrepreneur podcast | Entrepreneur | How to become an Entrepreneur | How to be an entrepreneur

-

Cover Story3 months ago

Cover Story3 months agoDonald Trump’s Impact on US-India Relation

-

Cover Story3 months ago

Cover Story3 months agoNarendra Modi Visionary Leader India Bright-Future

-

Cover Story3 months ago

Cover Story3 months agoMaha Kumbh Mela 2025 Prayagraj Journey of Faith

-

Politics1 month ago

Politics1 month agoRuby Phogat Yadav BJP Delegation Congratulates CM Rekha Gupta

-

Business3 months ago

Business3 months agoWomen Entrepreneurs Modern Economy

-

Pharma4 months ago

Pharma4 months agoIndia Pharmaceutical Industry Embracing Technology $130 Billion Future

-

EV3 months ago

EV3 months agoIndia New Guidelines EV Charging Stations Sustainable Mobility

-

Auto4 months ago

Auto4 months agoOsamu Suzuki’s Impact on India’s Automotive Industry: What You Need to Know