Politics

One Nation One Election Proposal: What You Need to Know

Prime Minister Modi’s proposal to hold simultaneous federal and state elections in India has sparked national debate. “One Nation, One Election” could reduce costs and increase voter participation, but it faces criticism for weakening India’s federal structure.

Prime Minister Narendra Modi’s proposal to hold simultaneous federal elections and state elections in India has sparked a strong national elections debate. The plan, called “One Nation One Election,” suggests holding both Lok Sabha (national parliament) and state elections every five years. While this idea is not new, it has recently gained attention, leading to both support and criticism.

“Reasons for Synchronizing Elections”

Supporters of the “One Nation One Election” plan argue that it would solve several problems.

The main reason for synchronization is to reduce the costs and efforts required to manage Indian elections. Right now, elections are held frequently, leading to high costs and a lot of administrative work. By merging the national and state elections, proponents believe the government could save money and make the election process more efficient.

Advocates also suggest that simultaneous elections could reduce voter fatigue. Holding one major election every five years could encourage more people to vote. Rather than having multiple elections spread across the year, this streamlined approach would help engage voters and keep the process simple. Supporters also argue that this plan would reduce the frequency of the Model Code of Conduct (MCC), which limits the government from announcing new policies during elections. This would allow for more consistent governance and long-term planning.

“Concerns and Criticisms”

Despite the potential benefits, many critics have raised concerns about the idea.

They argue that synchronizing elections might weaken India’s federal structure, which gives states significant control. By aligning state elections with national ones, local issues might be overshadowed by national political debates. This could make it harder for smaller, regional parties to focus on local concerns.

India’s political environment is highly diverse, with many regional parties that rely on state-specific issues to gain support. In a synchronized election, smaller parties might struggle to compete with larger national parties. Critics worry that this could further strengthen the power of national parties, diminishing the voice of regional leaders and constituencies.

The proposal also faces logistical challenges. The Election Commission of India would need significant resources, including more electronic voting machines (EVMs) and voter-verifiable paper audit trails (VVPATs). There are questions about whether it is feasible to conduct elections for over a billion voters at once, raising concerns about infrastructure readiness.

“Legal and Constitutional Challenges”

Implementing synchronized elections also faces legal obstacles.

Important sections of the Indian Constitution, such as Articles 83, 85, 172, and 174, would need to be amended. This process would require a two-thirds majority in both houses of Parliament and approval from at least half of the state legislatures, making the plan difficult to pass.

The ruling Bharatiya Janata Party (BJP), which supports the proposal, currently does not have the necessary majority in the Rajya Sabha (upper house of Parliament). The opposition, including regional parties, has strongly opposed the proposal, fearing it could lead to more centralization of power and reduce democratic participation at the state level.

“Looking Ahead”

The ongoing debate over “One Nation One Election” reflects the challenge of balancing efficiency with India’s diverse political system.

While the proposal aims to reduce costs and provide stable governance, it also raises concerns about weakening regional voices and undermining the autonomy of states.

It remains uncertain whether this proposal will become a reality. Much depends on how the government responds to the concerns raised by opposition parties and other stakeholders. The outcome of this debate will have a lasting impact on India’s democratic process and its governance for years to come.

Watch and Subscribe to the YouTube Channel: EBT Entrepreneur Business Times

Politics

Union Budget 2025 Tax Reforms: You Need to Know

The Union Budget 2025 introduces significant tax relief for salaried individuals, focusing on raising the tax exemption limit and revising tax slabs, benefiting the middle class.

The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, has unveiled a series of key tax reforms aimed at providing significant relief to salaried individuals, particularly the middle class. In a move to stimulate economic growth and increase disposable income, the government has proposed several measures that will directly benefit taxpayers across various income brackets. These reforms are seen as part of the broader strategy to boost consumption, savings, and investments, thereby fostering overall economic development.

“Increased Tax Exemption Threshold”

One of the most notable announcements in the Union Budget 2025 is the increase in the income tax exemption threshold.

Under the new provisions, individuals earning up to Rs 12 lakh annually will be completely exempt from paying income tax. This marks a significant rise from the previous exemption limit of Rs 7 lakh. This move is expected to benefit millions of salaried employees who will now retain a larger portion of their income, ultimately increasing their purchasing power.

With the increase in the exemption limit, taxpayers will have more flexibility in managing their finances and allocating funds toward savings, investments, and discretionary spending. The government’s decision to raise the tax exemption threshold reflects its focus on supporting the salaried middle class, which forms the backbone of India’s consumer-driven economy.

“Revised Tax Slabs to Provide Relief”

Along with the increased exemption limit, the government has also introduced revised tax slabs for the 2025-26 financial year.

The new structure includes several changes designed to reduce the tax burden on middle-income earners. The tax slabs are now as follows:

- Income up to Rs3 lakh: Nil

- Rs 3 lakh to 7 lakh: 5%

- Rs 7 lakh to 10 lakh: 10%

- Rs 10 lakh to 12 lakh: 15%

- Rs 12 lakh to 15 lakh: 20%

- Above Rs15 lakh: 30%

These changes are expected to significantly benefit taxpayers within the Rs 3 lakh to Rs 10 lakh range, who will see a reduced tax liability. For those earning above Rs10 lakh, the tax burden will remain, but the adjustment in the lower slabs is a move in the right direction, offering more financial flexibility for salaried individuals.

“Higher Standard Deduction for Salaried Employees”

The Union Budget 2025 also includes a generous increase in the standard deduction for salaried employees.

The deduction has been raised from Rs 50,000 to Rs 75,000 annually, providing an additional tax-saving opportunity. This increase is expected to reduce the taxable income of salaried employees and give them more take-home pay at the end of the month.

In addition to the standard deduction, the government has also increased the deduction available for family pensions. The deduction for family pensioners has been raised from Rs 15,000 to Rs 25,000, ensuring that senior citizens, who depend on pensions for their livelihood, receive much-needed relief.

“The middle class Benefits the Most”

The primary beneficiaries of these tax reforms are the salaried middle class, which has been facing the brunt of rising costs and inflation.

With more money in their hands due to reduced taxes, individuals will be able to increase their spending power, stimulating demand in various sectors of the economy.

Additionally, the revised tax structure aims to incentivize savings and investment, allowing individuals to invest more in instruments like mutual funds, pension schemes, and insurance policies. This shift towards greater financial independence and security is expected to have long-term positive effects on both personal finances and the country’s overall economic stability.

“A Boost to Economic Growth”

These reforms are not only designed to provide immediate relief to taxpayers but also to bolster long-term economic growth.

By enhancing disposable income and encouraging increased consumption, the government aims to stimulate demand and investment, which will, in turn, create jobs and contribute to India’s economic recovery and growth trajectory.

In conclusion, the Union Budget 2025 has delivered much-needed tax relief for the salaried middle class, with measures aimed at reducing the tax burden, increasing disposable income, and encouraging savings. These reforms mark a significant shift in India’s tax landscape and are expected to have a positive impact on the economy, driving growth and improving the financial well-being of millions of taxpayers. As the country navigates its path toward economic recovery, these tax measures will play a crucial role in shaping the future of India’s middle class.

Cover Story

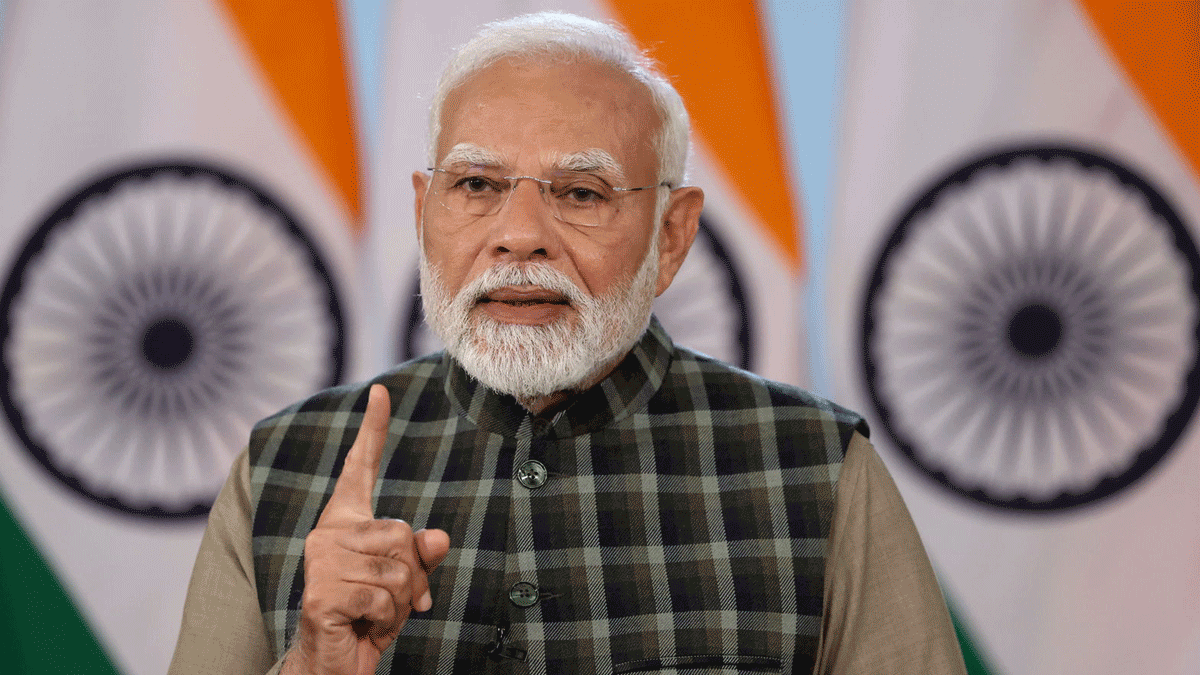

Narendra Modi’s Leadership and Vision for India’s Future: What You Need to Know

Narendra Modi’s leadership has reshaped India’s future with bold reforms, focusing on modernization and global partnerships.

Narendra Modi, the 14th and current Prime Minister of India, is one of the most influential leaders in modern India. Since taking office in May 2014, he has introduced bold reforms and policies that have reshaped India’s economy, governance, and global image. Known for his focus on development, innovation, and diplomacy, Modi has led India towards growth and modernization.

Early Life and Political Journey

Narendra Damodardas Modi was born on September 17, 1950, in Vadnagar, Gujarat. He came from a humble background and helped his father sell tea as a child. Later, he ran his own tea stall, reflecting his simple beginnings.

Modi showed an interest in politics from a young age. He joined the Rashtriya Swayamsevak Sangh (RSS), a nationalist group, where he gained leadership skills. He later joined the Bharatiya Janata Party (BJP) and rose through its ranks due to his dedication and hard work.

In 2001, Modi became the Chief Minister of Gujarat. He served for 13 years, making Gujarat a hub for industries and infrastructure. His success earned him national recognition and paved the way for his journey to become India’s Prime Minister.

Key Achievements as Prime Minister

Economic Growth and Infrastructure Development

Make in India (2014): Boosted domestic manufacturing and attracted global investments.

Digital India: Promoted e-governance, online services, and better internet access.

Startup India: Encouraged startups and entrepreneurship, making India a global startup hub.

Smart Cities Mission: Focused on modernizing urban areas with better infrastructure and facilities.

Social Welfare and Public Schemes

Swachh Bharat Abhiyan: Launched to promote cleanliness and sanitation, making India open-defecation-free.

Jan Dhan Yojana: Helped millions of people open bank accounts, promoting financial inclusion.

Ayushman Bharat: The world’s largest health insurance scheme, providing free treatment to low-income families.

PM Ujjwala Yojana: Provided free LPG connections to poor households, reducing the use of unhealthy fuels.

Foreign Policy and Global Leadership

Modi’s diplomacy has strengthened India’s position globally. He has focused on building partnerships through:

Closer ties with countries like the United States, Japan, and Israel.

Promoting the Act East Policy to improve relations with Southeast Asian nations.

Advocating for India’s permanent membership in the UN Security Council.

Defense and Security Strengthening

Led Surgical Strikes (2016) and Balakot Airstrikes (2019) to tackle terrorism.

Modernized defense forces and promoted ‘Make in India’ in defense manufacturing.

Focused on border security and internal safety measures.

Tackling Challenges and Reforms

COVID-19 Response: Managed India’s pandemic response, launched Vaccine Maitri, and oversaw the world’s largest vaccination drive.

Economic Reforms: Introduced Goods and Services Tax (GST) for a unified tax structure and demonetization (2016) to fight corruption and black money.

Leadership Style and Popularity

Narendra Modi is known for his strong leadership, communication skills, and strategic vision. His radio program, ‘Mann Ki Baat’, connects him directly with the people. Modi’s emphasis on nationalism, cultural values, and modernization has earned him widespread support.

His vision of a ‘New India’ focuses on self-reliance (Atmanirbhar Bharat), innovation, and sustainable growth.

Awards and Global Recognition

Global Statesman Award and Champions of the Earth Award for his leadership in environmental reforms.

Featured in Time Magazine’s 100 Most Influential People list multiple times.

Honored with the Legion of Merit by the United States and several other international awards.

“Vision for the Future”

Narendra Modi aims to make India a $5 trillion economy by focusing on digital transformation, industrial growth, and innovation. Programs like Gati Shakti for infrastructure and Har Ghar Jal for clean water access are designed to promote inclusive development.

As India celebrated 75 years of independence (Azadi Ka Amrit Mahotsav), Modi shared his dream of making India a global superpower by 2047, when the nation marks 100 years of independence.

“Conclusion”

Narendra Modi’s journey from a tea seller to India’s Prime Minister is an inspiring story of determination and success. His leadership is defined by bold reforms, development programs, and international diplomacy. While his decisions often spark debates, his focus on building a strong, modern, and self-reliant India has made him a transformative leader. With a vision for economic growth and global influence, Modi continues to shape India’s future as a rising power on the world stage.

Watch and Subscribe to the YouTube Channel: EBT Entrepreneur Business Times

Politics

Delhi CM Residence Renovation Controversy: What You Need to Know

A CAG report revealed that Delhi CM Arvind Kejriwal’s official residence renovation cost ₹33 crore, far exceeding the original ₹7.9 crore budget, sparking political and public scrutiny.

A recent report by the Comptroller and Auditor General (CAG) has caused a stir in Delhi’s political scene. It revealed that the renovation of Delhi Chief Minister Arvind Kejriwal’s official residence exceeded the initial budget of ₹7.9 crore, ballooning to over ₹33 crore. The findings have raised serious concerns about how public funds are being managed, especially given the lavish spending on luxury items and the project delays extending into 2023.

“Budget Overruns and Luxury Spending”

The renovation of the Delhi CM’s residence was originally approved with a budget of ₹7.9 crore.

The goal was to make the residence safer and more functional. However, the final cost far exceeded expectations, with a significant portion of the budget being spent on expensive furniture, high-end fittings, and lavish decor. Critics argue that such luxury spending is hard to justify, especially when many Delhi residents are struggling with rising costs of living and unemployment. The extravagant nature of this spending on Arvind Kejriwal’s residence raises questions about the government’s priorities when public resources could have been allocated elsewhere.

“Delays and Project Management Issues”

What was intended as a quick renovation project turned into a prolonged affair, dragging on into 2023.

This delay has sparked accusations of poor planning and mismanagement. The Aam Aadmi Party (AAP) government is being criticized for failing to manage the project efficiently, leading to concerns about accountability and control over public funds. Critics point out that the extended timeline reflects a lack of control over public spending, which is critical during times of financial strain.

“Missing Documents Raise Concerns”

One of the most troubling aspects of the CAG report is the missing documentation.

Many key records and approvals were reportedly not available for review, making it difficult to verify the legitimacy of the spending. This has led to growing calls for a thorough investigation into how taxpayer money was used and whether the renovation costs were justified. The lack of transparency in the documentation process has added fuel to the fire, with critics demanding accountability for how funds were spent on the Delhi CM renovation.

“Political Reactions and Criticism”

Opposition parties, particularly the Bharatiya Janata Party (BJP), have used the CAG findings to attack Kejriwal and his administration.

BJP leaders accused the Delhi Chief Minister of misusing public resources for personal luxuries. They suggest that the final renovation costs could have reached up to ₹80 crore, much higher than the reported ₹33 crore. The BJP also criticizes the AAP for being disconnected from the struggles of common people, pointing out the excessive nature of the renovation while many citizens face economic hardships. The spending on luxury items for the residence is being framed as a symbol of government inefficiency and disconnect from the public’s needs.

“Delhi Government’s Response”

In defense, the Delhi government argues that the renovation was necessary to ensure the safety and functionality of the Chief Minister’s residence.

AAP officials maintain that the project followed proper government procedures and that the spending was justified for maintaining the property. However, they have yet to address concerns about the luxury spending or the missing documentation, which remains a point of contention for critics.

“Calls for Transparency and Accountability”

The controversy over the renovation of the Delhi CM’s residence has become a key issue in Delhi’s political discussions.

Calls for greater transparency and accountability in government spending are growing, especially when taxpayer money is involved. The BJP is pushing for a detailed investigation, which could become a significant political challenge for Kejriwal and the AAP. This situation underscores the need for proper financial management and accountability, particularly in times of economic strain. The controversy surrounding the renovation has raised broader questions about the allocation of public funds, especially when many people in Delhi are struggling financially.

This ongoing controversy is likely to continue to shape political conversations in Delhi, with both sides demanding further scrutiny of public spending and whether such extravagant projects are justified during difficult economic times. The public’s growing concerns about luxury spending at the Delhi CM’s residence highlight the need for a more responsible approach to managing public funds and ensuring that taxpayer money is used wisely.

Watch and Subscribe to the YouTube Channel: EBT Entrepreneur Business Times

-

Cover Story2 weeks ago

Cover Story2 weeks agoDonald Trump’s Key Policies: Essential Insights You Need to Know

-

Cover Story2 weeks ago

Cover Story2 weeks agoMaha Kumbh Mela 2025: Essential Insights You Need to Know

-

Cover Story2 weeks ago

Cover Story2 weeks agoNarendra Modi’s Leadership and Vision for India’s Future: What You Need to Know

-

Business2 weeks ago

Business2 weeks agoWomen Entrepreneurs’ Impact on Business Growth: What You Need to Know

-

Pharma1 month ago

Pharma1 month agoIndia’s Pharma Industry Transformation: What You Need to Know

-

EV1 month ago

EV1 month agoIndia’s New EV Charging Guidelines: Essential Insights You Need to Know

-

Auto1 month ago

Auto1 month agoOsamu Suzuki’s Impact on India’s Automotive Industry: What You Need to Know

-

Pharma1 month ago

Pharma1 month agoIndia’s Pharmaceutical Growth: What You Need to Know